Stocks soared this morning in anticipation of Joe Biden’s inauguration and another round of government stimulus. With vaccine rollouts underway, bulls believe it’s only a matter of time until “revenge spending” takes effect. Experts have been quick to blame vaccine delays for the market’s inability to truly break out over the last week.

They say pent up demand – a phrase often uttered by market optimists – is being held back by the slower-than-expected vaccine deployment.

“It’s pure chaos. I predicted it would be pure chaos. I never thought it would be this bad,” CNBC’s Jim Cramer said.

“If President Biden just says on Day One, ‘It’s a do-over. We’ve got plans, military get ready,’ I think this market could explode.”

He continued, adding:

“I think we’re all beleaguered. I think an orderly transfer of power, coupled with a well-defined plan to give us vaccines as they roll out, will make it so this market can go up tremendously. Everything else, I’m not saying it’s irrelevant but you can’t get this economy open until we’ve figured out how to get the vaccines from Pfizer and Moderna into our arms.”

If Cramer’s right, and the only thing holding back the U.S. economy is a timely vaccine rollout, then the market should rally soon after Americans reach herd immunity.

Biden says he plans on distributing 100 million vaccine doses in his first 100 days with the help of FEMA and the National Guard. That plan could go awry, of course, and that’s not even considering how much of the U.S. will refuse the rushed-to-market, first-of-its-kind vaccine.

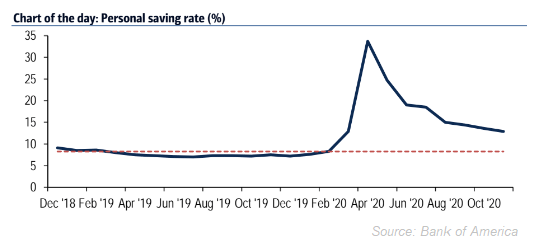

Regardless, Wall Street seems to agree with Cramer. A morning note from Bank of America illustrated just how much spending money is waiting on the sidelines. More importantly, B of A analysts identified where consumers are likely to use that cash during the presumed “vaccine-induced renaissance.”

“In the last 10 months fiscal policy has been operating with one hand tied behind its back. Normally fiscal stimulus causes a surge in spending on both goods and services, but during the COVID crisis the latter has been severely constrained,” wrote the bank’s strategists.

“As a result, many households have taken both their unspent service spending and their stimulus money and put it into liquid saving. This could mean a delayed, second round stimulus when the service side of the economy reopens.”

Current data suggests that Bank of America’s got a good grasp of the savings situation. Excess M2 balances, or the liquid monetary supply in the U.S. (including checking, savings, and money market accounts) totals around $2.9 trillion. And that doesn’t even factor in the most recent $900 billion stimulus package or the future $1.9 trillion one.

Even if Biden can only push $1.1 trillion through, which many analysts say is a more realistic expectation, the savings rate should rebound greatly, earmarking another major chunk of cash for revenge spending.

“[We] expect the first package to help boost the saving rate from 13.2% in 4Q to 15.5% in 1Q. Extrapolating the calculation above, that means around another $100 bn in ‘excess saving,’” explained B of A analysts.

“Without factoring the second stimulus package the Bloomberg consensus already has a median forecast of 4.1% growth this year and [we’re looking] for 5.0% growth.”

The only obstacle preventing this from happening is a Covid-related mishap. Poor vaccine rollouts, underwhelming vaccine performance, or a vaccine-resistant mutation could spoil the party.

But, at some point, those excess savings will eventually be brought to bear.

Keep in mind that much of it has been artificially provided by the federal government. A “Biden Bounce” is coming, but will it be enough to help the U.S. achieve escape velocity and extend the current economic cycle?

Probably not. Rising rates, dollar woes, and continued stimulus will only compound the West’s long-term problems. The financial structure is going to reach a breaking point, and probably during Biden’s presidency, whether he can help it or not. The U.S. was put on this path back in 2009.

Twelve years and a pandemic later, the end may finally be in sight. But it’s not a good one, sadly, and it likely involves a deep recession preceded by a market crash.

Investors who are in it for the very long-term won’t get hit too hard, but traders that are looking toward the next few years need to prepare for the coming insanity. Stocks will surge and the spending bonanza will begin. Everyone will celebrate a return to pre-Covid times.

Meanwhile, the average American household will watch its wealth quietly get siphoned away, thanks to an endless stream of stimulus and dovish Fed behavior – things that have only made the wealth gap far worse, not better, in a bitterly divided “United” States.