Stocks climbed even higher today as the S&P jumped 0.4% in response to Meta earnings and an encouraging GDP. The Dow traded flat while the Nasdaq Composite enjoyed a notable 0.9% leap.

Meta shares rallied 8% on the day following better-than-expected quarterly results and a bullish outlook. A rebound in ad revenue was the main catalyst for these positive figures. Meanwhile, Chipotle Mexican Grill took a 7% hit as its sales fell short of estimates.

Results have generally outpaced expectations this earnings season. FactSet data indicates that 81% of companies that have reported thus far have bested analyst predictions.

The same could be said for the US economy, which showed impressive resilience in the second quarter, posting stronger-than-expected GDP growth. The economy expanded by 2.4% from April to June, according to data from the Commerce Department, significantly surpassing the 1.8% rate predicted by economists. This showed a bounce back from an also stronger than anticipated 2% growth rate in the first quarter.

This data comes hot on the heels of the US central bank’s decision to raise its benchmark interest rate to the highest level in 22 years in an attempt to beat back inflation. Yet, in spite of the Fed’s aggressive tightening, the economy continues to seemingly flourish, creating some dissonance in the narrative of an imminent major recession as suggested by the inverted yield curve.

On the price front, gross domestic purchases increased by 1.9% in the second quarter, slowing from a 3.8% rise in the first. The personal consumption expenditure (PCE) index similarly rose 2.6% in the second quarter, down from a 4.1% increase in Q1. The PCE “core” price index saw a 3.8% increase after rising by 4.9% in the prior quarter, falling short of the 4.0% estimate. Core PCE is the Fed’s favorite inflation gauge, making the cool print particularly bullish.

Real disposable personal income (DPI) grew by 2.5% in the second quarter, following an 8.5% rise in Q1. This increase largely reflected a rise in compensation, income receipts on assets, rental income, and personal current transfer receipts.

This generally bullish economic data has kindled hopes that the Fed can orchestrate a “soft landing,” tempering inflation without causing significant economic damage. But there are also worries that this resilient economy might complicate the task of pulling inflation back to the Fed’s 2% target.

Fed Chair Powell addressed these concerns during yesterday’s Post-FOMC press conference:

“My base case is that we will be able to achieve inflation moving back down to our target without the kind of really significant downturn that results in high levels of job losses.” However, he also acknowledged the potential risks of robust growth leading to escalated inflation.

Wharton School’s Jeremy Siegel felt similarly.

“Those very high rates that scared me and the market earlier on in the year don’t seem to be having as much of a negative effect as I had feared. And that, combined with the fact that Powell now is saying I’m going to look at both sides of the equation, I think is very positive for the markets,” Siegel said this morning.

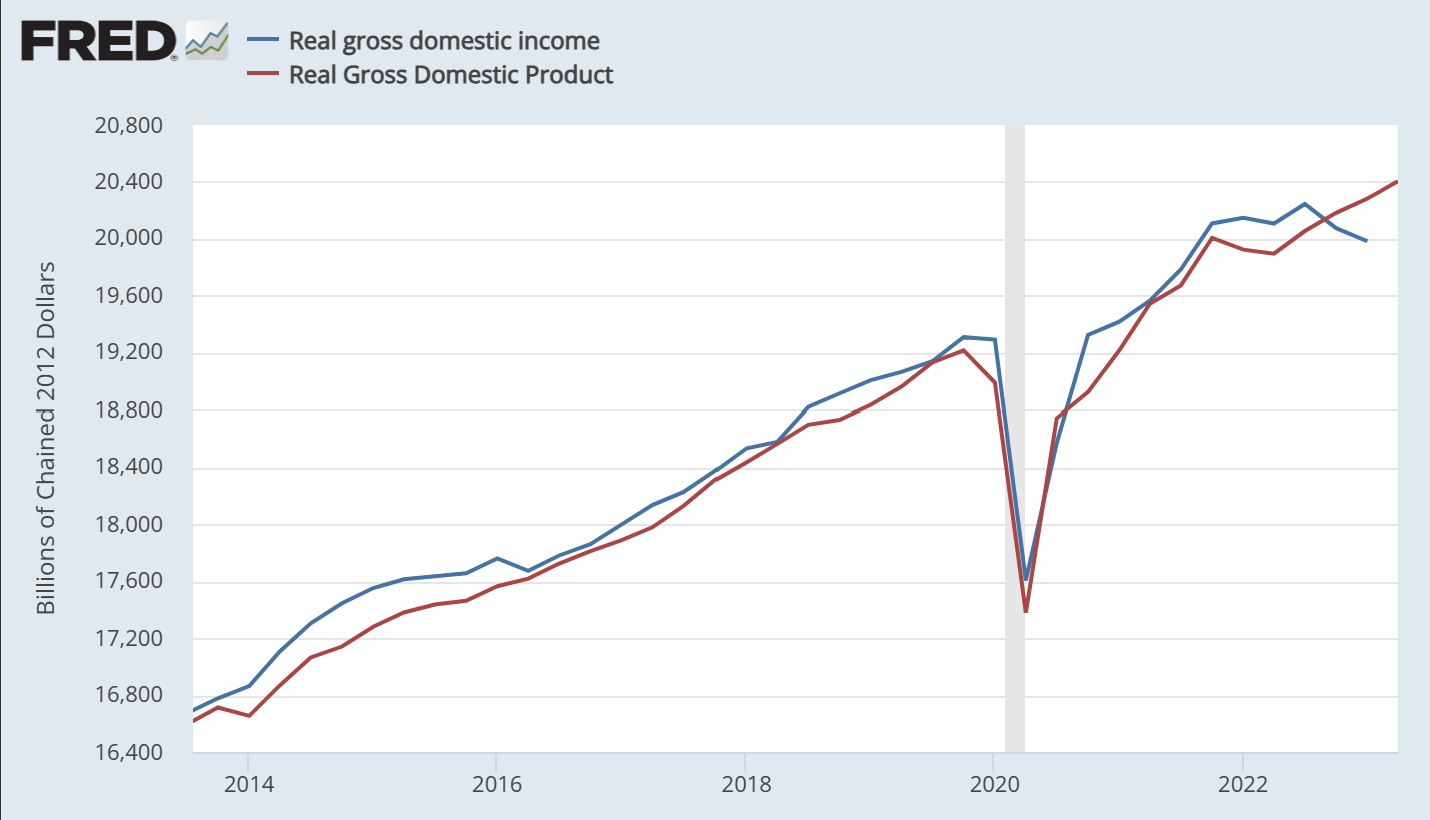

But is the GDP data legitimate? Skeptics have noted (myself included) that much of the US economy’s recent gains were the result of major revisions and a surge in trade. The new discrepancy between GDI (gross domestic income) and GDP has raised some eyebrows, too.

GDI, which is a measure of a nation’s economic activity based on all of the money earned for all of the goods and services produced by that nation, has different inputs than GDP. Historically, there has been a small difference between the two numbers.

Starting in Q3 2022, however, GDI growth started to plummet while GDP accelerated. The most recent GDI reading from Q1 2023 showed a record-setting discrepancy with GDP. This is another one of those situations where the gap needs to eventually close.

The question is, will GDI suddenly spike higher with a recession approaching? Or will GDP fall? The latter seems far more likely, especially as cheap debt from the post-Covid rate cuts is increasingly replaced by higher-interest debt, which was likely a major reason why the coming recession has been delayed.

These are longer-term problems, though, so in the meantime, don’t be surprised if the market continues to tick higher, even with stocks looking very overbought in the short-term.