Stocks fell slightly this morning during the Halloween trading session. The Dow, S&P, and Nasdaq Composite all slipped, guided lower by rising Treasury yields. The 10-year Treasury yield jumped to 4.03% after spending much of last week below 4.00%.

Overall, though, bulls have little to complain about following the market’s big rally that began in mid-October. Dow stocks did most of the heavy lifting as the index was on track to close out its best month since 1976.

The tech-heavy Nasdaq Composite lagged by comparison due to a series of huge Big Tech earnings misses.

Despite last week’s gains (and Friday’s major rally, in particular), investors remain nervous with another “make-or-break” moment facing markets.

“Stocks are taking a breather after the big run last week,” said Carson Group chief market strategist Ryan Detrick.

“Then, considering the always important Fed meeting and interest rate decision on Wednesday, a pause makes even more sense.”

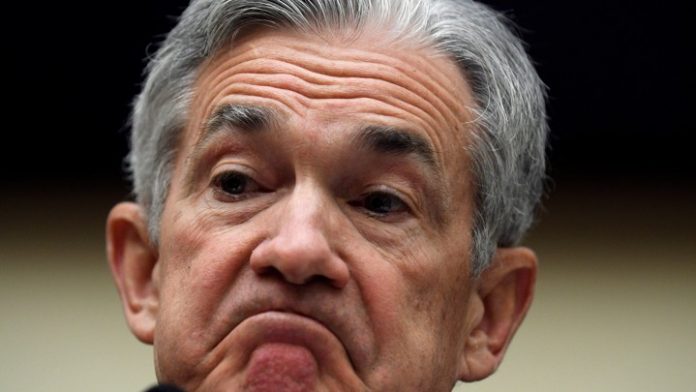

Investors are expecting a 75 basis point rate hike this Wednesday. And, outside of a massive surprise, Fed Chairman Jerome Powell should match expectations.

What the market wants clarity on is what the Fed has planned for December and beyond. That makes Wednesday’s post-hike press conference much more important than the hike itself.

“Wednesday’s message will be crucial for market expectations going forward,” explained LPL Financial’s Quincy Krosby.

“With the question and answer segment for the presser, Chairman Powell will have to finesse his answers as if he were walking a monetary tightrope.”

Bulls want Powell to say that he’ll decrease the size of the rate hikes going forward, stepping down December’s hike from 75 basis points to 50.

And while a drop to 50 would be short-term bullish, the irony here is that it would also allow the Fed to extend its hikes out further than anticipated.

In other words, if the Fed opts for smaller hikes, it will raise rates the same amount as it would have with larger hikes, but it will take a little longer to reach that terminal rate.

That’s not necessarily a good thing, as it would draw out the ongoing earnings deceleration even further. If Powell slams on the brakes hard and fast, the economic pain will be more severe, but the recovery will arrive sooner as well.

The risk there, however, is that raising rates too fast would break something in the bond markets. But if that happens, the US Treasury is expected to issue short-term bonds in order to buy longer-term, illiquid bonds, triggering another “operation twist.”

The last time we saw a “twist” was in 2011 when the Fed sold short-term bonds and bought long-term ones to stimulate the economy. Economists have spent the last decade arguing whether or not it worked.

This time around, though, the US Treasury would be doing the “twisting” by issuing short-term debt instead of selling it in an attempt to provide liquidity.

The challenge there is that eventually, the “twist” would have to end. And, when it does, liquidity problems would quickly return.

The point is that both scenarios – a 75 basis point hike or a 50 basis point hike – would result in long-term problems. But, in the short term, bulls definitely want to see a pivot to 50 basis points in December. If Powell hints at that Wednesday, get ready for stocks to soar as the seasonal tendency for the market to go up through the holidays takes over.