Stocks opened higher this morning on vaccine hopes as bulls took control. Stimulus talks in Washington, which are supposedly going well, had investors feeling confident, too.

But by midday, the market pared back some of its early gains. It’s exactly what happened yesterday, just before bears roared through the afternoon and drove equities lower.

If investors are treated to a repeat performance today, that could spell trouble for the ongoing vaccine rally.

Especially with the current bull run looking a little long in the tooth.

On Wall Street, however, that hasn’t impacted sentiment in the slightest. Bank of America’s December Fund Managers Survey, published this morning, revealed a persistent bullishness among survey respondents.

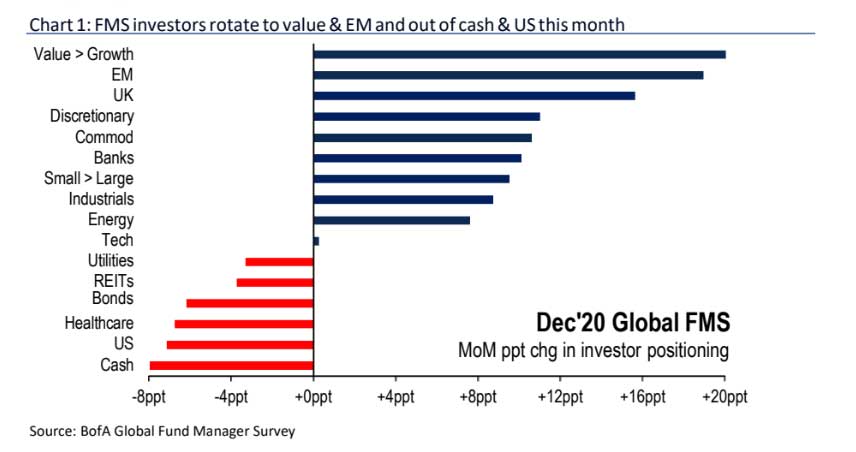

Fund managers like emerging markets, consumer stocks, and commodities for the current month. Opposite those, they aren’t so hot on holding cash, U.S. stocks, or healthcare shares.

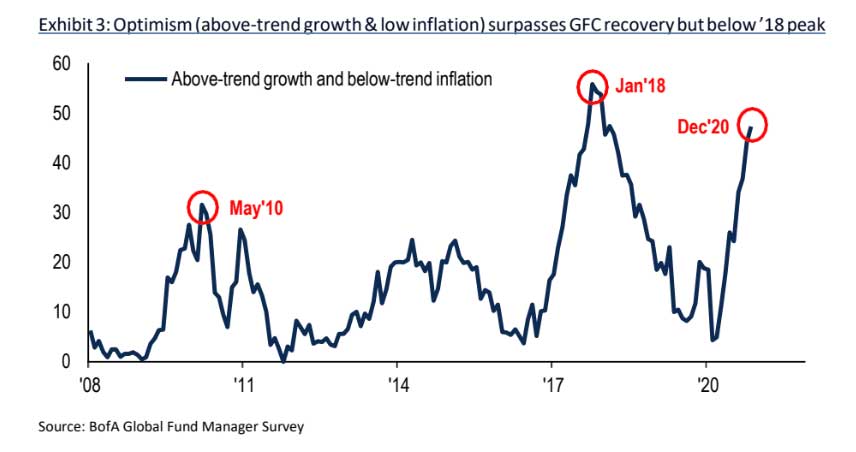

The survey also found that Wall Street is optimistic about better-than-expected economic growth and low levels of inflation:

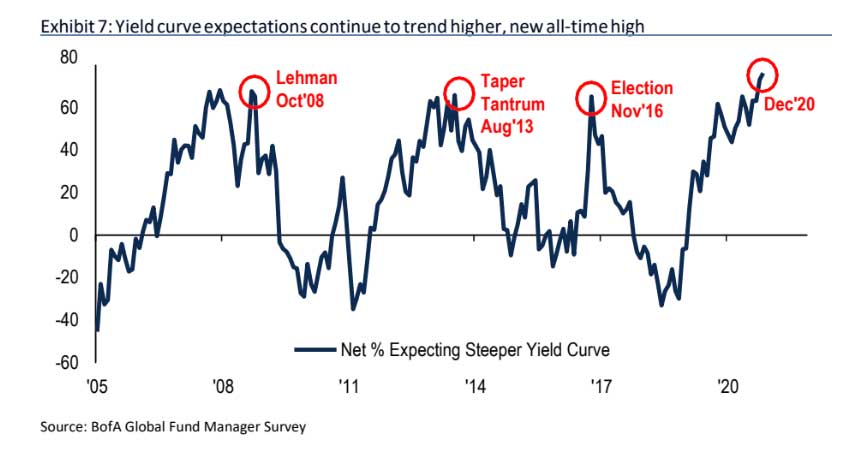

On the other hand, fund managers believe the yield curve will steepen as well, which typically happens when investors expect stronger economic growth and rising inflation to go with it:

In fact, yield curve expectations actually hit an all-time high this month, surpassing 2008, 2013, and 2016 prior to the presidential election.

That bodes poorly for cash (as reflected in the first chart), but very well for stocks. It also helps explain the general bullishness found by the survey.

If superior economic growth is on its way, it’d be a good idea to keep buying equities.

But what Bank of America’s report didn’t disclose is the reasoning for why fund managers feel this way. Supported by a “firehose” of liquidity from central banks (and government stimulus), the market may have effectively been backstopped in terms of nominal, long-term gains.

In terms of real returns, though, fund managers are likely far less optimistic. The expected steepening of the yield curve (second chart) shows that they think inflation’s going to spike.

If that happens, the market will go up simply because dollars will be going down. Gold and Bitcoin should also surge. If corporate earnings beat expectations, stocks will enjoy some real gains, too.

But most of the inflation-driven rally will be fake; “froth” created by a plunging dollar.

So, that would make the bullish sentiment exhibited by fund managers relatively phony as well. They’re equity bulls because they have nowhere else to hide.

Remaining in cash, as shown in the first chart, is simply out of the question.

So, while the market’s long-term prospects still look good nominally, that doesn’t necessarily suggest there’s any optimism about creating real wealth.

Does that mean it’s time to dump stocks? Not at all. The risk of a short-term pullback is legitimate, but the biggest hazard for investors is letting their cash get eaten-up by inflation. Investing that cash into the market, where equities can keep pace with inflation, is the smarter move.

Instead, cash alternatives like gold and Bitcoin could be the more attractive option, alongside small cap stocks that end up outperforming the rest of the market.

But Bitcoin and small caps are still seen as mostly unsafe investments. Gold, meanwhile, has spent months selling-off.

With few places left to bury their heads in the sand, it’s no surprise to see fund managers remaining staunchly bullish.

Because Wall Street, along with its clients, simply doesn’t have any other choice.