After a tense week of trading, stocks got off to a much better start this morning. The major indexes soared at the open as the first doses of Pfizer’s Covid-19 vaccine began to roll out.

By noon, however, the market retraced most of its early gains. Continued uncertainty over stimulus and the U.S. economy has bulls feeling less optimistic.

“Politically, debate continues on another fiscal bill, which is much needed for much of the population, but will also create an even larger ‘wall of cash’ for consumers to spend as economies fully reopen,” explained Tavis McCourt, institutional equity strategist at Raymond James, to clients over the weekend.

“It is abundantly clear the economy is slowing as local shutdowns continue, but any impact on the equity market has been limited so far. Whether this continues into 1Q is unclear, but our guess is pullbacks will be limited unless something materially changes in the vaccine story.”

Overall, though, sentiment remains positive. Especially down on Wall Street, where many analysts see 2021 as a breakout year for risky assets.

And not just in the West, either.

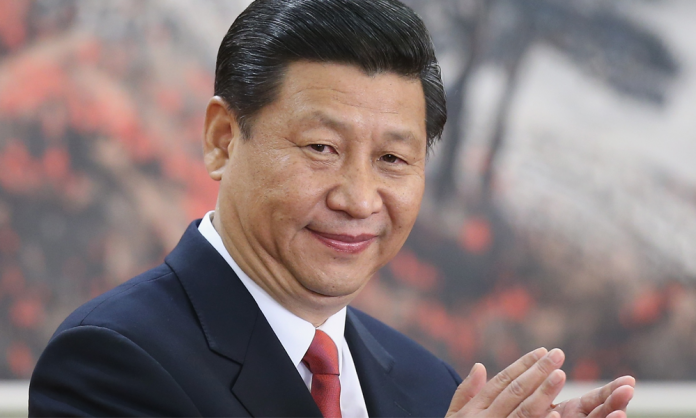

A recent survey from Bloomberg found that strategists have become overwhelmingly bullish on emerging markets. Unsurprisingly, post-coronavirus China is now their top pick for stocks, bonds, and even currencies. Relatively speaking, Chinese stocks offer a far superior value to American ones.

The Shanghai Composite is still below its 2018 highs. The S&P 500, meanwhile, is trading at a record high.

If you had to choose one group of stocks vs. the other, the more attractive option would be the Chinese offerings by a mile. Over 200 million students in China are attending school and an economic recovery is well underway.

Stateside, children are still learning remotely and a “firehose” of liquidity is keeping the market afloat.

But perhaps the biggest bullish influence on Chinese companies is their notable credit growth, which looks to have finally peaked last month. Outstanding credit fell to 13.6% in November, down from 13.7% in October, marking the first decline in over a year.

Chinese policymakers are taking their foot off the gas in that regard, and it might ding sentiment over the next few weeks as investors realize that.

However, credit growth typically leads emerging markets by roughly five to six months. Rising credit impulse – the change in new credit issued as a percentage of the gross domestic product (GDP) – is followed by rising (non-precious) metal prices, and ultimately, stocks.

So, while some analysts will point to China’s credit decline as a reason to bail on its companies, the truth is that those stocks should have about half a year until they reach the top.

Keep in mind, the relationship between credit impulse and emerging markets has been observed in a non-pandemic world. In 2020 and 2021, anything’s possible.

But the macroeconomic reasoning for a continued Chinese recovery is sound. Of all the major powers, China’s the one that should emerge from Covid-19 smelling like roses, and in a far better position (relative to the U.S.) than it was pre-pandemic.

All while central banks in the West, despite their best intentions, decimate the dollar and Euro, hoping to spur-on growth.