The Dow (+0.05%) and S&P (+0.20%) are trading relatively flat again this morning while the Nasdaq Composite enjoys a modest gain (+1.00%). It’s a hiccup in the growth-to-value rotation, and one that comes as a bit of a surprise during the shortened holiday trading session.

Much of the daily shift back to growth (and tech, specifically) can be attributed to Black Friday. Online retailers are offering deep discounts on brand name goods, and this year, have expanded Black Friday to cover the entire week. The National Retail Federation expects holiday sales growth ranging from 3.6% to 5.2% year-over-year. That’s a marked increase from the average yearly growth of 3.5%.

And outside of retail shares, it’s been a great November for other stocks as well. A series of vaccines sent the major indexes to new all-time highs and the Fed hinted at an additional round of quantitative easing (QE).

With stimulus talks also ongoing, bulls may have a significant “backstop” for equities heading into 2021.

“What we’re witnessing today, this week and this month, is a continuation in the rise of optimism,” explained Mike Zigmont, head of trading and research at Harvest Volatility Management.

“The environment for risk assets has been getting better and better.”

In response, the Cboe Volatility Index (VIX) has fallen considerably. The “fear index” is currently at its lowest level since February, before the coronavirus pandemic rocked the markets.

Contributing to the newfound stability is President Trump’s comments about whether he would transition out of the White House should the Electoral College elect Joe Biden.

“Certainly I will. Certainly I will. And you know that,” Trump said, before commenting that “massive fraud” would make it hard to rationalize conceding.

Trump’s legal team has several ongoing lawsuits disputing election results in key states. The investing landscape could change dramatically depending on how those go.

For now, Wall Street assumes Biden’s secured the win.

But the biggest driving force seems to be a working Covid-19 vaccine. So far, several major drug companies have vaccine solutions that, according to those companies, are highly effective.

Analysts are still pointing to the vaccines as a reason to remain bullish about an economic recovery.

“As we inch closer to that ultimate health solution […] we’re starting to see market participation broaden out and rotate into some of the more impaired sectors through the course of this pandemic,” Bill Northey, senior investment director at U.S. Bank Wealth Management, said.

“As we turn the corner, that is going to allow pent-up economic activity to return.”

While having an effective vaccine is great, and it should undoubtedly calm many coronavirus-related fears, the truth is that the Fed – not a “Covid cure” – is likely the market’s most critical ally.

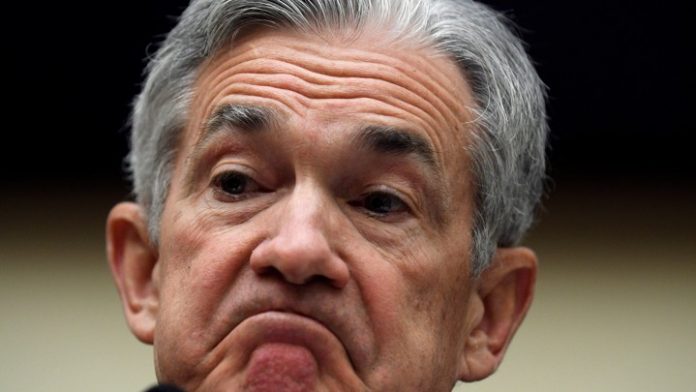

On many occasions since the pandemic began, Fed Chairman Jerome Powell has said that the Fed will continue to support the U.S. economy until a complete recovery has been made. It doesn’t matter how long it takes for a vaccine to be deployed.

Nor does it matter if Congress can agree on a major stimulus deal.

Because the Fed will be there, time and time again, to “grease the wheels.” Since 2008, that’s always been the case. And after a series of economy-killing lockdowns, the Fed has even more reason to keep the U.S. dependent upon QE.

Regardless of how hard it hits the dollar, or, via inflation, millions of American households.