Stocks are flat again this morning while investors consider relatively sky-high share prices. It’s only been roughly 3 months since the March 23rd lows, and the market is up almost 40%. Prior to the plunge of two weeks ago, the major indexes were on a collision course with new all-time highs.

In fact, the Nasdaq Composite managed to achieve that goal and still sits above its pre-crash levels, even with coronavirus cases spiking across the country and a completely stalled rally.

Bulls remain very much on the recovery bandwagon, though. Retailers like Gap (NYSE: GPS) and Walmart (NYSE: WMT) are keeping the broader markets from diving into negative territory. Really any company that stands to benefit from an economic reopening is rising.

Some analysts, however, believe consumers need much more than a “green light” from the government to kick their shopping habits back into gear.

“The areas of concern that weighed on stocks Friday afternoon were reinforced over the weekend,” wrote Adam Crisafulli, founder of Vital Knowledge.

“Governments look set to proceed with reopening, but the real driver of growth will be behavioral normalization and that is very likely to be impended by the steady negative coronavirus news flow.”

On Friday, the U.S. reported an additional 30,000 coronavirus cases, marking the single largest daily increase since May 1st. Over 23 states are seeing an uptick in infections. Apple (NASDAQ: AAPL), in response, is re-closing some of its stores. Cruise ships have suspended all voyages until September 15th, too.

Regardless, sentiment skews neutral among investors.

“There’s a war going on between the bulls and bears, with each seizing every little data point to buttress their opposing arguments,” wrote Fundstrat Global Advisors market intelligence analyst Vito Racanelli in a note.

“I do think that perhaps the market has gone past its recovery ‘straight-up’ phase, as investors realized coronavirus (COVID-19) was not a world ender. But the data remains mixed and Covid-19 fear remains strong, and it’s understandable.”

Small-time traders don’t seem to care, though. Instead, they’ve only gotten more bullish as larger-scale speculators have sunk deeper into a bearish pit.

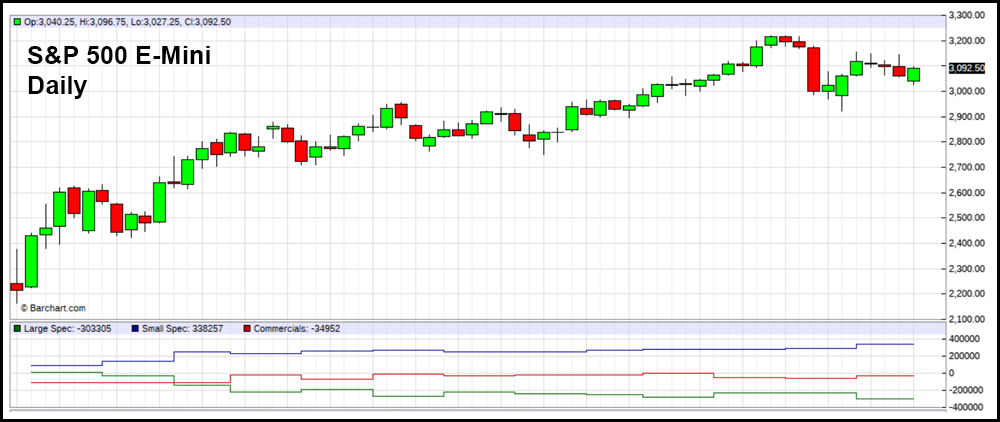

In the daily candlestick chart above, the S&P 500 E-Mini has been plotted above its Commitments of Traders (COT) data – a weekly market report issued by the Commodity Futures Trading Commission (CFTC) that reveals the holdings of participants in several different futures markets.

The blue line in the chart corresponds with small speculators, who are mostly retail traders that don’t report to the CFTC. Opposite them are large speculators – professional traders and funds – that are required to report to the CFTC. The red line represents commercial traders that also report to the CFTC.

The COT data gives investors insight into the number of positions (long vs. short) held by different types of traders. In this up-to-date chart, small speculators are very bullish and have gotten even more so over the last few months as the market has risen.

Long speculators, by comparison, are growing increasingly bearish. This is widely considered a classic bearish setup, because it usually means retail investors have gone overboard while the funds and professional traders are getting ready for a correction. Large speculators have a better track record of timing the market, making this disconnect particularly dangerous for bulls.

The only added condition that would make this more bearish would be a sudden 2-week downtrend in small speculator positions types – another bearish variable that has often preceded market-wide corrections. Once small speculators begin to lose faith in the rally following a bullish peak, they’ll scramble to join the large speculators, launching a rapid collapse.

We’ve said for weeks now that the market looked overbought. Large scale investors seemed to think so, too, and hedged their bets with more intensity as time went on.

Eventually, the “dam” of positivity will break. If nothing else, the COT data shows us that it’s coming soon.

Moreover, that when it arrives, it could signal the official end of the post-crash, post-Covid-19 rally.

In potentially dramatic – if not historic – fashion.